Welcome to thegreateconomy.com, where we break down the financial side of your favorite brands! I’m Jasmin, and today, we’re diving into the world of the Victoria’s Secret Credit Card. Whether you’re obsessed with a Victoria Secret bra, eyeing a Victoria Secret tote bag, or curious about your Victoria Secret gift card balance, this card might seem like a dream for brand loyalists. But hold off on applying—there are some secrets you need to know first. From Bare Vanilla Victoria Secret scents to Victoria Secret slippers, this card’s perks come with fine print. Let’s uncover the five biggest things you should know before signing up!

- Choose Your Style: Four Card Options to Fit Your Vibe

- Big Spenders Get Bigger Rewards

- Rewards Expire Fast—Don’t Plan a Big Splurge

- Perks Come with Hidden Minimums

- High Interest Rates Can Burn You

1. Choose Your Style: Four Card Options to Fit Your Vibe

Just like picking the perfect Victoria Secret sports bra or Victoria’s Secret 40d bra, the Victoria’s Secret Credit Card comes in four flavors to match your style and spending habits. Issued by Comenity Bank, here’s the lineup:

- Victoria Credit Card: Sleek black with the iconic VS logo, this store-only card works at Victoria’s Secret and PINK (in-store and online).

- PINK Credit Card: Rocking a bold pink design with the PINK logo, it’s also store-only for Victoria’s Secret and PINK purchases.

- Victoria Mastercard Credit Card: Black with a Mastercard logo, this one’s usable anywhere Mastercard is accepted.

- PINK Mastercard Credit Card: Light pink and Mastercard-branded, it’s accepted worldwide.

All four cards earn the same rewards at Victoria’s Secret and PINK, whether you’re shopping for Victoria Secret thongs or Victoria Secret lip gloss. You apply through one application, choosing between black or pink designs, but Comenity Bank decides if you qualify for the store-only or Mastercard version based on your credit. So, whether you’re grabbing a Victoria Secret wallet or browsing during the Victoria Secret semi-annual sale, pick the card that fits your vibe!

https://www.victoriassecret.com/us/credit-card

2. Big Spenders Get Bigger Rewards

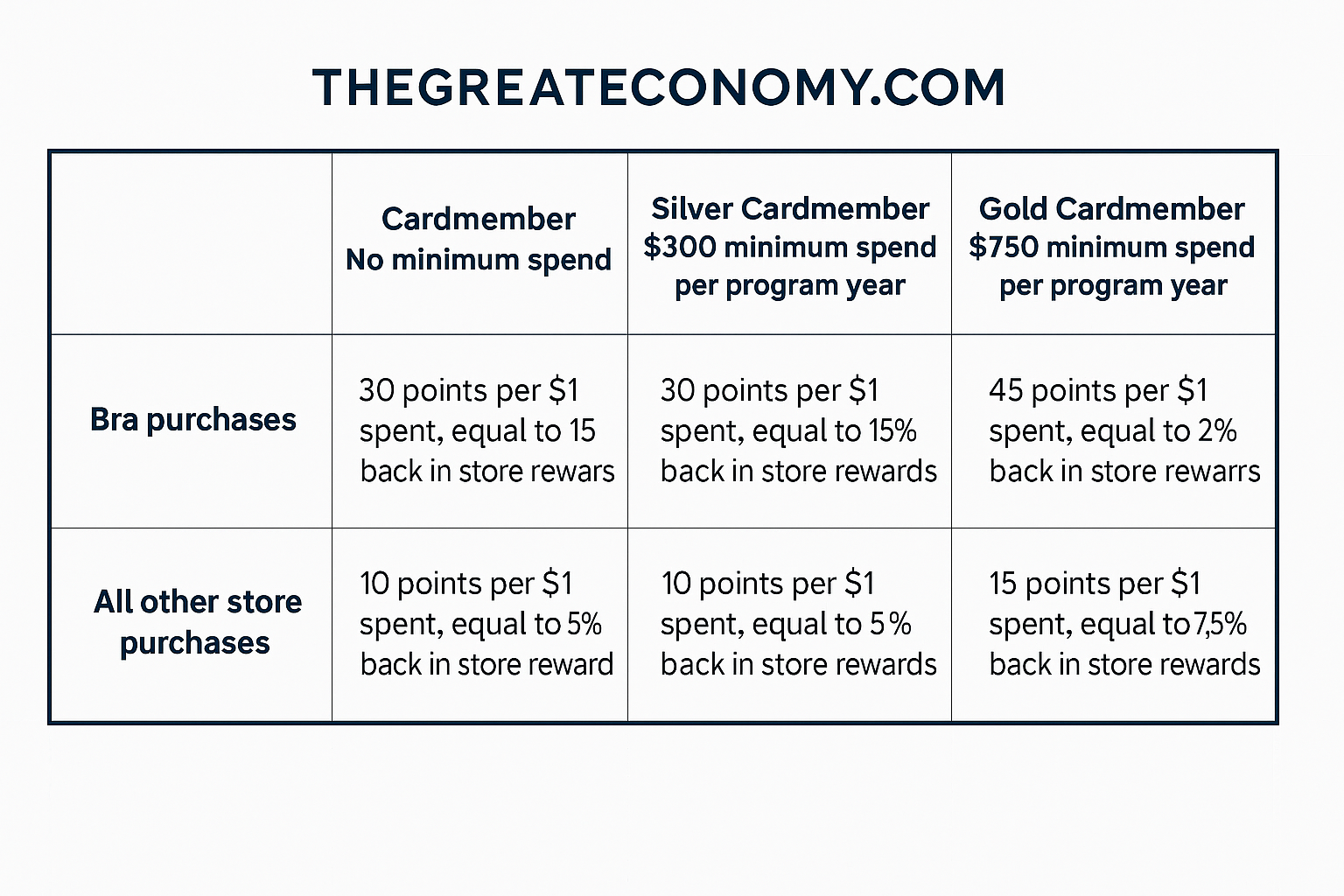

If you’re a frequent shopper splurging on Love Spell Victoria Secret fragrances or Victoria Secret leggings, this card’s rewards structure is built for you. The more you spend, the higher your tier, and the better your rewards. Here’s the deal:

- All cardholders earn rewards on Victoria’s Secret and PINK purchases, like a Victoria Secret bra or Bare Vanilla Victoria Secret body mist.

- Higher tiers (based on annual spending) unlock better rewards rates. For example, if you’re buying 15+ bras a year (averaging $50 each, like a Victoria’s Secret 40d bra), you could rack up serious points.

- Mastercard versions also earn:

- 4 points per $1 (2% back) on dining, travel, and streaming.

- 2 points per $1 (1% back) on all other non-Victoria’s Secret/PINK purchases.

Casual shoppers grabbing a Victoria Secret tote bag or Victoria Secret slippers won’t see much reward value, but big spenders? You’re in for a treat.

3. Rewards Expire Fast—Don’t Plan a Big Splurge

Here’s a big catch: you can’t save up points for a major haul, like stocking up during the Victoria Secret semi-annual sale. Rewards are issued in $10 increments for every 2,000 points, and they expire in just 90 days. So, if you’re hoping to use your Victoria’s Secret gift card alongside rewards for a big purchase, you’re out of luck. This setup pushes you to keep spending, whether on Victoria Secret lip gloss or Victoria Secret thongs, rather than saving for something special.

4. Perks Come with Hidden Minimums

The Victoria’s Secret Credit Card dangles some shiny perks, but they come with strings attached. Here’s what you get:

- $25 off your first purchase (great for a Victoria Secret sports bra or Victoria Secret wallet).

- $10 birthday discount ($15 for Gold-tier cardholders spending $750+ annually).

- Silver-tier perks ($300+ annual spend): $10 half-birthday discount and 15% off your card anniversary.

- Gold-tier perks ($750+ annual spend): $15 half-birthday discount and 20% off your card anniversary.

The catch? Each perk requires a minimum purchase, and Victoria’s Secret doesn’t disclose the amount until you’re approved. You might need to spend more than planned on Victoria Secret leggings or Bare Vanilla Victoria Secret products to use these discounts, which can eat into your savings.

5. High Interest Rates Can Burn You

The rewards might catch your eye, but the interest rate is a dealbreaker if you carry a balance. As of April 2023, all versions of the card (Victoria, PINK, and Mastercard) have a 29.74% variable APR—nearly 10% above the 2022 national average for credit cards. If you’re not paying off your balance monthly after shopping for Love Spell Victoria Secret or Victoria Secret slippers, the interest could outweigh any rewards. For most, a general-purpose rewards card offers better value unless you’re a die-hard fan checking your Victoria Secret gift card balance regularly.

Final Thoughts

The Victoria’s Secret Credit Card can be a great fit for loyal shoppers who live for Victoria Secret bras, Victoria Secret tote bags, or the Victoria Secret semi-annual sale. But with expiring rewards, hidden minimums, and a sky-high APR, it’s not for everyone. At thegreateconomy.com, we’re all about helping you make smart financial choices. So, weigh these secrets carefully before applying, and let Bright T. know in the comments if you’ve got questions about this card or your favorite Victoria’s Secret products!

2 Comments